‘Service for Profit’ Models in Medical Field Service: A look at 2017

According to the International Trade Administration (ITA), the U.S. is the largest medical device market in the world, with a market size of around $148 billion—which will reach $155 billion in 2017. But in 2016, healthcare organizations entered a period of consolidation, in which mergers and acquisitions created a decrease in market size and a thinning out of original equipment manufacturers’ (OEMs) portfolios.

Even among top tier OEMs, their similar products are creating a crowded market, so that distinguishing oneself becomes increasingly difficult.

As a result, companies are utilizing their service channels as a differentiator to drive revenue. According to a recent survey from the Field Service Medical 2016 event, service has become a top priority for these companies, despite the fact that most currently receive very little of their profit from services.

Now, services must go beyond the basic necessities of minimizing fix times and maximizing repair success rates. The responsibility falls to technicians, who are increasingly expected to please the customer above and beyond simply fixing the machine.

As a revenue channel, service must integrate its existing functions with those of sales. Technicians are expected to sell SLAs and do other customer-facing (rather than machine-facing) activities, as discussed. These new field staff need to possess both “hard” and “soft” skills, acting as both the engineer and charismatic salesperson. Consequently, labor utilization and training—especially on mobility and networking technologies—are enormous priorities, as management considers how to retrain the current technicians and revise their hiring models.

The following is an analysis of the Field Service Medical 2016 event survey data providing insight into key areas of business for OEMs in 2017. We will address some key questions raised in this section, including:

- Why is customer satisfaction important to service as a revenue channel?

- What role does labor utilization play in creating a profit?

- What kind of technologies contribute to these initiatives, and how are they used?

And we will address the larger question of how service companies can create a successful ‘service for profit’ workforce.

Growth Methods & Opportunities

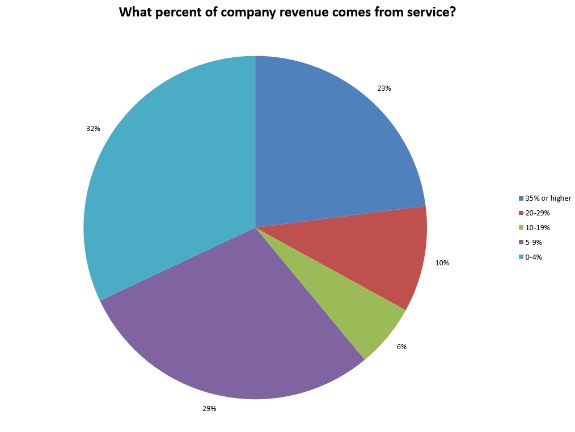

Currently, the majority of companies (61%) receive 9% or less of their revenue from service, where roughly half of that group (32% of total companies polled) receive 4% or less. However, the next largest group—23% of companies—receives 35% or more of their revenue from service, indicating medical field service companies are at either end of the spectrum in terms of how service is already contributing to their bottom lines.

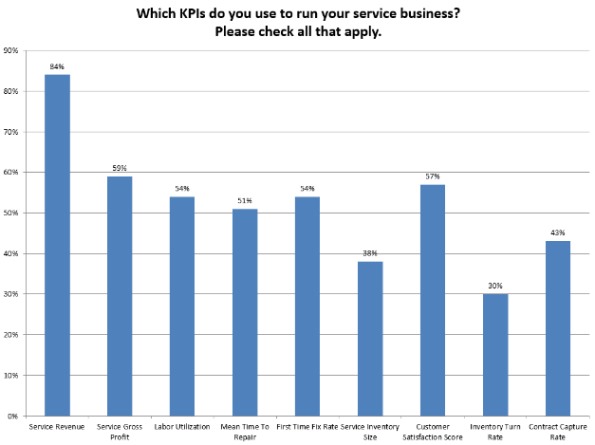

But as the industry begins to focus on after-market service quality as a brand differentiator, increasing service revenue has become a top priority for a majority of businesses, as reflected in their key points of interest (KPIs). Among nine different KPIs medical field service companies use to run their service businesses, service revenue was selected by 84% of companies, the largest group. Service gross profit (59%) similarly places emphasis on service companies as channels for revenue.

But alongside these popular KPIs, we find customer satisfaction score (57%) and labor utilization (54%) as priorities among a majority of companies, indicative of service companies’ transformation into a revenue channel by means of their personnel, which will be explored later in this analysis.

It’s notable that these priorities were priorities for about as many companies with first time fix rate (54%), and mean time to repair (51%), traditional KPIs for field services. The remaining KPIs—contract capture rate (43%), service inventory size (38%), and inventory turn rate (30%) were selected by smaller groups of companies.

Technology as an opportunity for growth

Technologies like connectivity for products and service reps have become a growth strategy for a majority of medical field service companies seeking to improve service processes and increase customer satisfaction.

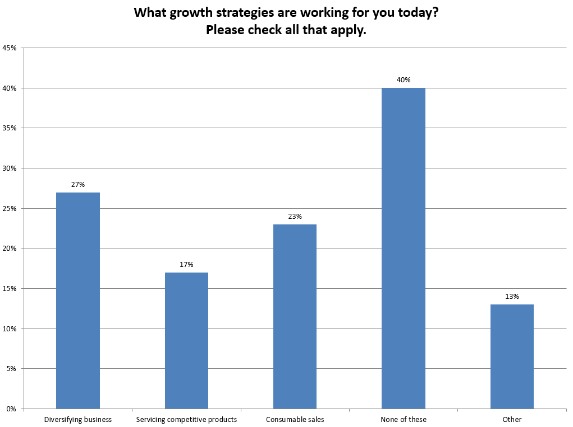

Many companies are no longer seeing progress from mainstream growth strategies such as business diversification, servicing competitive products, and consumable sales, where 40% claim none of these strategies are working, and 13% claim there are other growth strategies that are working for them.

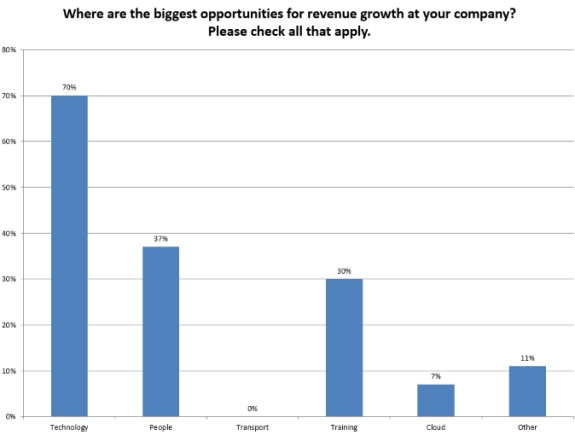

Meanwhile, a significant majority of companies (70%) identify technology as one of the biggest opportunities for revenue growth at their companies. Their people (37%) and training (30%), two related subjects, are comprised of the next largest groups. 7% of companies identified the Cloud, and 0% identified transport. 11% identify with opportunities that are not represented.

Technology adoption is not only a necessity to remain competitive in terms of service quality and efficiency; it is also a means by which companies are delivering greater satisfaction to their customers and driving brand loyalty. New technologies empower service reps to carry out their increasing sales responsibilities, and take advantage of opportunities to cross- and up-sell to customers who might benefit from a greater service commitment to their companies.

Transitioning Operations to a Customer Satisfaction Role

A 2015 study by Aberdeen, called State of Service Management 2015: Connecting with Your Customers, reveals that customer satisfaction became the top metric defining success in service, over operational efficiency and cost containment. Most often measured by first time fix rates and mean time to repair, medical field service companies are increasingly dependent on their operations and service personnel—who may already have more interactions with customers than sales and marketing teams—to make their engagements with customers a part of their profit strategies.

Once considered only cost centers, companies are increasingly integrating their service teams with sales departments, as executives begin to realize that after-market service is a critical component to customer satisfaction and loyalty.

Methods for driving customer satisfaction

Empowering service reps to carry out sales activities begins with giving them information that empowers them to increase customer satisfaction, which allows for cross-selling and up-selling on the part of the service rep. Consequently, building a knowledge base with both customer information and collateral is an integral part of connected service reps to sales and marketing teams.

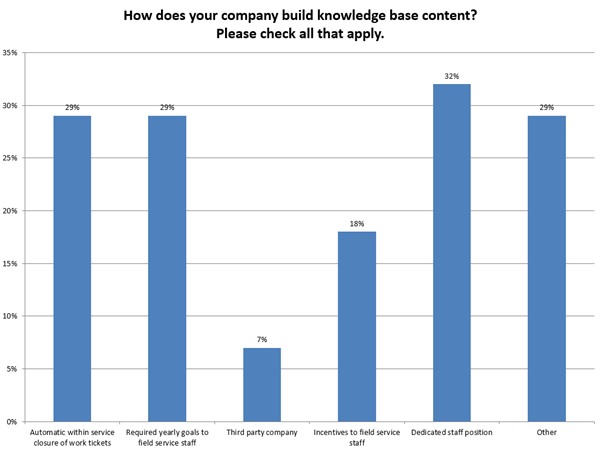

In 2016, companies are somewhat stratified across five different methods to building their knowledge base content, though 32%--the largest group—claim they have a dedicated staff position (32%) to do so. Other companies automate the process within service closure of work tickets (29%).

Incentivizing service reps or otherwise making it a part of their workflow is also popular, where required yearly goals to field service staff (29%) and incentives to field service staff (18%) are considered. Few use a third party company (7%), while 29% use some other method.

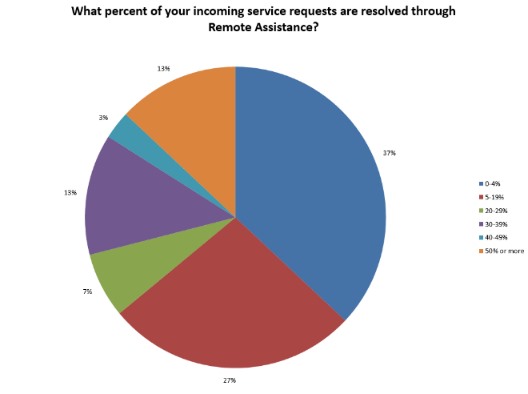

Service companies are also identifying more convenient, cost-effective methods for carrying out service operations, including through self-service portals or remote assistance. Already, 23% of companies are resolving 20% - 49% of their incoming service requests through remote assistance, where 13% of all companies are resolving at least half of their incoming service requests in this way.

However, as is the case with revenue for services, companies are on either end of the spectrum, with 37% of all companies resolving 4% or fewer of incoming service requests though remote assistance.

Whether taking charge of service responsibilities or customer satisfaction, one noticeable trend is companies’ transition into a more technology-driven future—creating efficiencies through remote services and automation, and creating superior service teams through connectivity and mobile technologies as well.

Personnel Orientation & Development

Customers are demanding more than a service rep who can arrive on site and fix medical devices when they break. In fact, they want to see diagnostics tools being used so that the machine doesn’t break in the first place—or at the very least have a technician fix the problem remotely if it does.

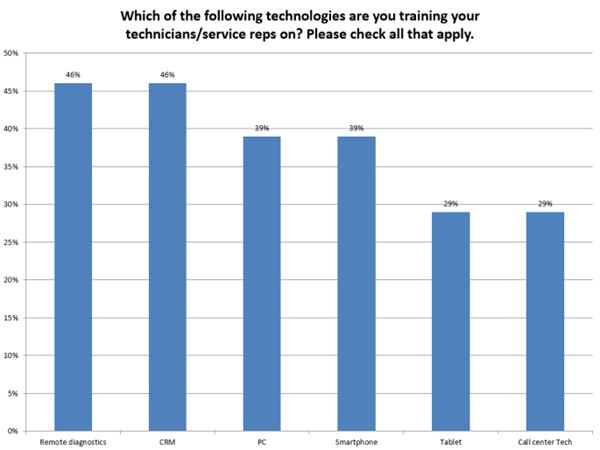

Currently, companies are training their technicians and service reps on a wide range of technologies, most notably remote diagnostics (46%) and customer relationship management (CRM) systems (46%). PCs (39%), smartphones (39%), and tablets (29%) are also popular technologies; as well as call center technologies, also at 29%.

In addition to delivering services remotely, these technologies lend themselves to delivering on sales initiatives through service reps’ soft skills, as well as accessibility to critical customer data, marketing and sales collateral.

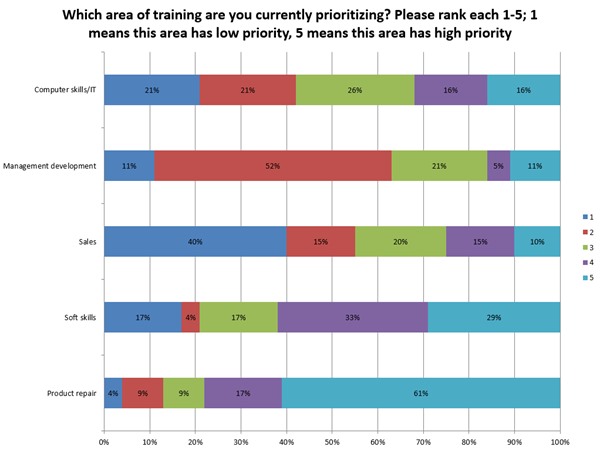

Trends in terms of training indicate the customer-facing role is becoming a greater priority as well. Although companies lean heavily towards product repair as a ‘top priority,’ so that 61% of companies identify it as of the highest priority above, companies’ emphasis on soft skills leans heavily towards the high priority side of the range as well, where the majority of companies identify soft skills training as either a level 5 (29%) or level 4 (33%) priority.

Meanwhile, computer skills and IT is evenly distributed across the priority range, while management development and sales skew towards the bottom.

Opportunities through personnel retention

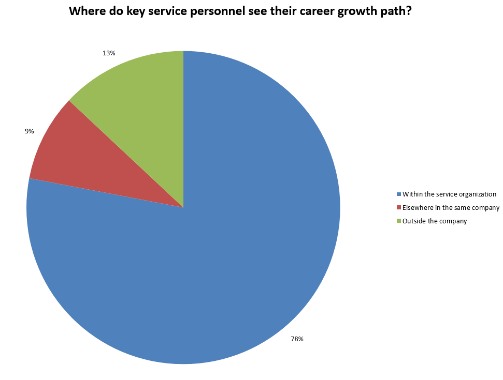

These companies have a high probability of retaining employees and building both subject matter and technology expertise. 78% of key service personnel see their career growth path moving forward within their own service organizations, while 9% claim their career growth path will be outside the service organization but within the same company. Only 13% see their career growth path as being outside of their companies.

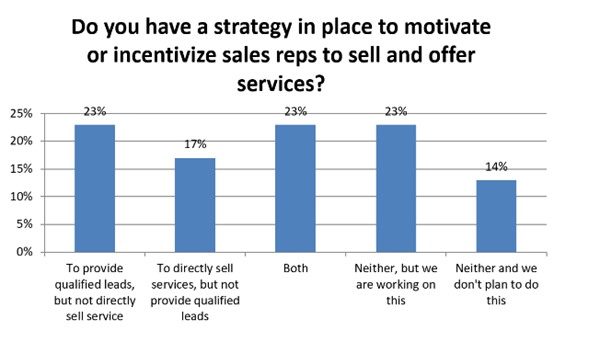

Sales incentives may play a substantial role in growing this loyalty, as well as revenue. When asked whether or not they have a strategy in place to motivate or incentivized sales reps to sell and offer services, 23% of companies claim their strategy is to provide qualified leads, but not directly sell service.

Conversely, 17% of companies claim their strategy is to directly sell service, but not provide qualified leaves. Another 23% of companies claim they do both, so that a total of 63% of companies have a strategy in place to incentivize or motivate their sales reps.

Outlook for 2017: Your Profit is in Your People

As medical field service companies increasingly orient their technology, operations, and personnel strategies towards improving the customer experience, they are doubling efforts to increase efficiencies through remote services and connected technologies as well.

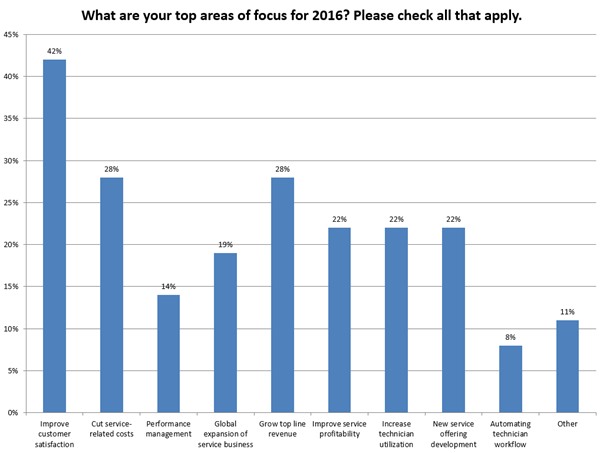

In terms of their top areas of focus for 2017, 42% of companies identify improving customer satisfaction (42%) as a top area of focus—the largest group. Cutting service-related costs (28%) and growing top line revenue (28%) receiving the next highest numbers.

Companies prioritize improving service profitability (22%), increasing technician utilization (22%), and developing new service offerings (22%) as well, which also contribute to the growing customer satisfaction profitability scheme.

Less identified priorities include global expansion of service business (19%), performance management (14%), and automating technical workflow (8%). 11% of companies claim at least one top area of focus is not among the options available.

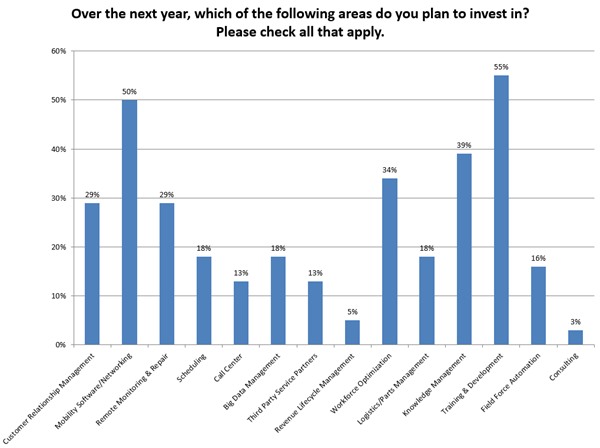

But in the service-for-profit future, companies must depend on the quality and expertise of their service reps to deliver not only on service expectations, but customer experience and efficiency requirements as well. That’s why at least half of companies plan to invest in both training and development (55%) as well as mobility software/networking (50%) in 2017.

In each case, more than a quarter of companies intend to invest in knowledge management (39%), which empowers service reps with access to both collateral and customer data; workforce optimization (34%), which streamlines operations and the customer experience; customer relationship management (29%), which centralizes customer data in a strategic way for sales, service, and marketing teams; and remote monitoring and repair (29%), which improves service, and customer satisfaction as well.

18% or fewer companies plan to invest in scheduling (18%), Big Data management (18%), logistics/parts management (18%), field force automation (16%), call center (13%), third-party service providers (13%), revenue lifecycle management (5%), and consulting (3%).

Let’s revisit our original three questions:

Why is customer satisfaction important to service as a revenue channel?

Due to equalization of product offerings in the market, the customer experience, and subsequently customer satisfaction, is now the most important differentiator for medical field service companies to remain competitive today; and service channels provide the greatest range of opportunities for improving them.

What kind of technologies contribute to these initiatives, and how are they used?

Leading technologies in medical field services could be described as both operational and customer-facing—where mobility helps personnel both resolve service issues more quickly and identify opportunities to up-sell; and remote diagnostics improve operations while sparing the customer a time-consuming service visit. Operational efficiencies aside, driving brand loyalty and sales opportunities are these technologies’ greatest contributions to the bottom line.

What role does labor utilization play in creating a profit?

Even as companies utilize technologies like remote assistance and even service rep connectivity to improve service and customer experiences, service rep training is the greatest variable and on-point determinant of how service channels can drive that differentiation in the market. After optimizing technology, maximizing investments in personnel is the greatest strategy service organizations have for driving profit—ironically, possibly the most traditional approach to business success of them all.